– Warburg Pincus announced the successful close of Warburg Pincus Financial Sector III, L.P. (WPFS III) at $3.0 billion

– WPFS III launched in 2024 with an initial target of $2.5 billion

– WPFS III is the firm’s largest Financial Services fund to date

– Over five decades, Warburg Pincus has invested nearly $27 billion in more than 160 financial services companies

– The firm invests globally across banks, insurance, asset and wealth management, specialty finance, payments, and financial services-focused software, infrastructure, and services

– Notable financial services investments include AA, Avanse, Banc of California, EverBank, Foundation Risk Partners, GCash, IntraFi, Kestra, Mellon Bank, McGill & Partners, and Procare

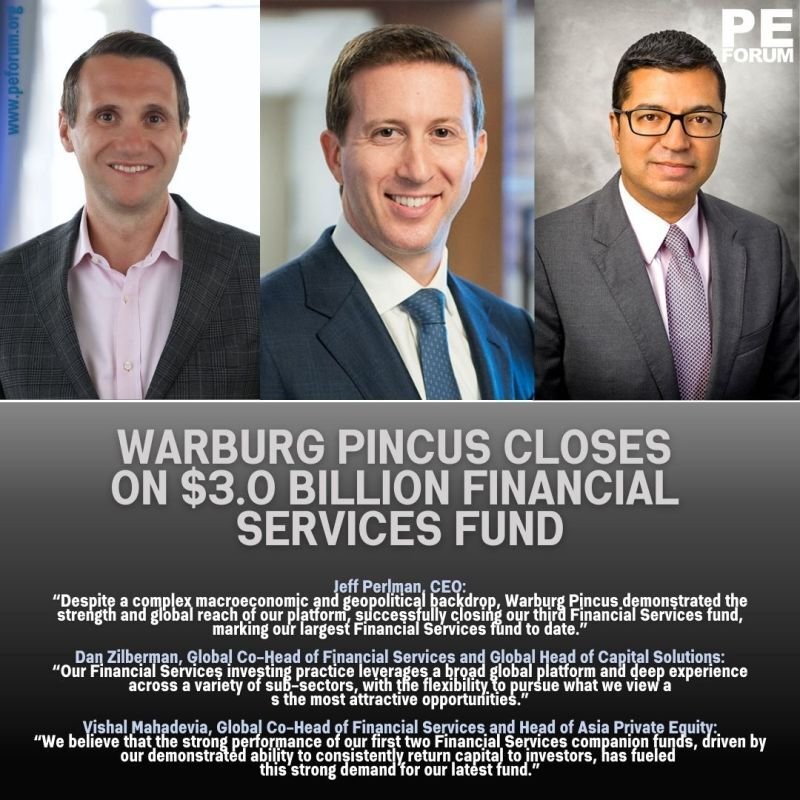

– Jeffrey Perlman, CEO: highlighted the firm’s global platform strength, limited partner trust, and disciplined, long-term, investor-first approach amid a complex macroeconomic and geopolitical environment

– Daniel (Dan) Zilberman, Global Co-Head of Financial Services and Global Head of Capital Solutions: emphasized the flexibility of the global platform and long-term growth opportunities driven by digital transformation, emerging markets, and rising household wealth

– Vishal Mahadevia, Global Co-Head of Financial Services and Head of Asia Private Equity: noted that strong performance and capital returns from earlier funds supported strong investor demand and position the firm to capitalize on secular and cyclical trends

– The Financial Services practice includes over 40 dedicated investment professionals globally

– WPFS III follows the close of Warburg Pincus Global Growth 14 at $17.3 billion, exceeding its $16 billion target

– It also follows the $4.0 billion close of the Capital Solutions Fund (WPCS FF), surpassing its $2.0 billion target