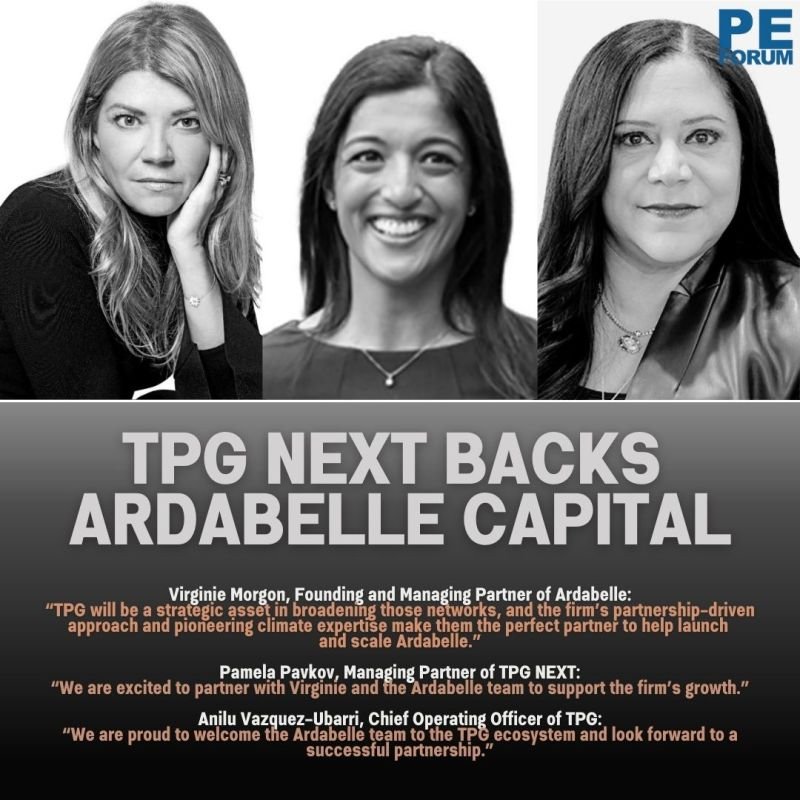

– Ardabelle Capital, a private equity firm focused on sustainable and resilient economic transition, has partnered with TPG NEXT through a strategic anchor fund commitment.

– Founded in 2024 by Virginie Morgon, Ardabelle invests in profitable mid-market industrial, services, and technology businesses driving sustainable value chains.

– “The Ardabelle strategy is rooted in our ability to invest in regional champions and scale them to be international leaders,” said Virginie Morgon, Founding and Managing Partner of Ardabelle.

– Ardabelle focuses on areas such as resource preservation, value chain digitization, material circularity, and sustainable logistics.

– “Virginie is an experienced investor with a history of identifying differentiated opportunities,” said Pamela Pavkov, Managing Partner of TPG NEXT.

– Ardabelle’s founding team includes seven partners with backgrounds from Eurazeo, McKinsey, SUEZ, Carlyle, Danone, and the World Economic Forum.

– “We are focused on partnering with innovative managers like Ardabelle that bring a unique combination of experience, clarity of strategy, and vision,” said Anilu Vazquez-Ubarri, Chief Operating Officer of TPG.

– With TPG’s support, Ardabelle gains access to global resources, strategic capital, and climate investing expertise to fuel its growth.