– TELEO Capital Management, LLC (“TELEO”) is an operationally focused private equity firm investing in lower middle market enterprise software companies.

– TELEO announced the final close of TELEO Capital II (“Fund II”) at its hard cap of $350 million in Limited Partner capital commitments.

– Fund II was oversubscribed and attracted a diverse group of new and existing institutional investors.

– TELEO follows a time-tested strategy in the lower middle market, leveraging a large purpose-built team and repeatable process to deliver consistent, outsized returns.

– Fund II will focus on acquiring mission-critical software divisions of large corporations.

– TELEO provides large corporate sellers with speed and certainty to close, minimal post-closing distraction risk from shared services agreements, and protection of customer and employee relationships.

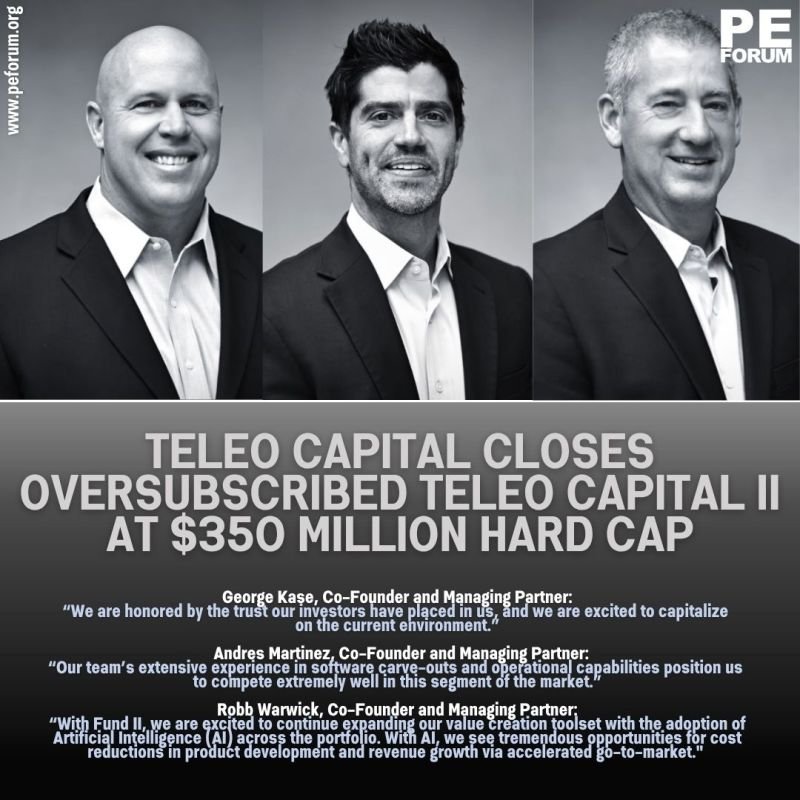

– George Kase, Co-Founder and Managing Partner, emphasized the trust placed by investors and the firm’s readiness to capitalize on the current environment.

– Andres Martinez, Co-Founder and Managing Partner, highlighted the team’s extensive experience in software carve-outs and operational capabilities.

– Robb Warwick, Co-Founder and Managing Partner, noted that Fund II will expand value creation through the adoption of Artificial Intelligence (AI) for cost reduction in product development and accelerated revenue growth.