– Pelican Energy Partners announced the successful closing of Pelican Energy Partners Base Zero LP (“Base Zero” or “the Fund”) at $450 million, surpassing its target of $300 million and the initial hard cap of $400 million.

– Base Zero is Pelican’s first fund focused on control buyout and growth investments in nuclear energy services and equipment companies.

– The Fund attracted commitments from a range of institutional LPs, including endowments, foundations, family offices, pension plans, and prominent gatekeepers.

– The Pelican team also provided a substantial GP commitment, contributing to the fund’s momentum.

– Pelican has raised more than $1 billion for energy service and equipment investments since 2012, with over fifteen fully realized investments in this sector.

– Base Zero targets the growth and improvement of nuclear services companies, which are crucial for sustaining and enhancing nuclear power generation.

– Nuclear energy accounts for nearly 20% of U.S. electricity and almost 50% of U.S. carbon-free electricity, both key to achieving base load reliability and de-carbonization.

– As of the final close date, the Fund had completed six platform investments, with additional opportunities expected before year-end.

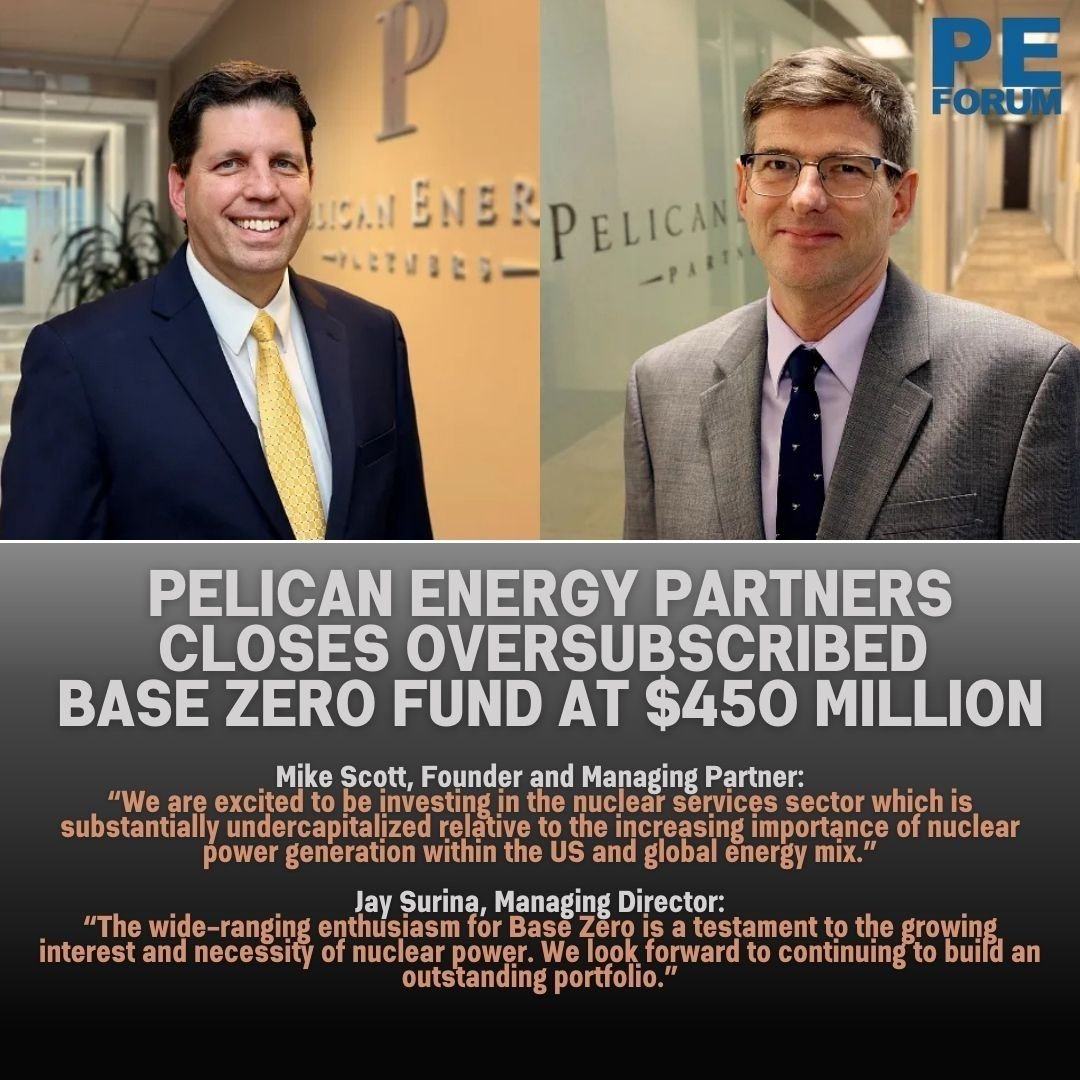

– Mike Scott, Founder and Managing Partner, highlighted the undercapitalization of the nuclear services sector and the growing importance of nuclear power in both U.S. and global energy.

– Jay Surina, Managing Director, emphasized the enthusiasm for Base Zero, reflecting the increasing necessity of nuclear power and the potential for significant value creation and returns.

– Calpa Partners LLP acted as the global placement agent and advisor on the fundraise, while Kirkland & Ellis served as fund counsel.