– Neuberger Berman announced the successful close of NB Strategic Co-Investment Partners V (“Fund V”) with over $2.8 billion in capital commitments.

– The fund exceeded its $2.25 billion target and surpassed the size of its predecessor fund.

– This achievement reflects growing investor appetite for GP-centric strategies.

Neuberger now manages over $40 billion in dedicated co-investment capital across its platform.

– Fund V aims to build a diversified, global portfolio of direct equity co-investments alongside top-tier private equity firms.

– Diversification is targeted across industries, private equity managers, enterprise values, and vintage years.

– The fund’s investor base includes public and private pension funds, insurance companies, foundations, family offices, and high net worth individuals worldwide.

– Fund V builds on nearly 20 years of Neuberger’s experience in managing co-investment strategies through various market cycles.

– The firm is recognized as a preferred capital solutions provider for private equity sponsors.

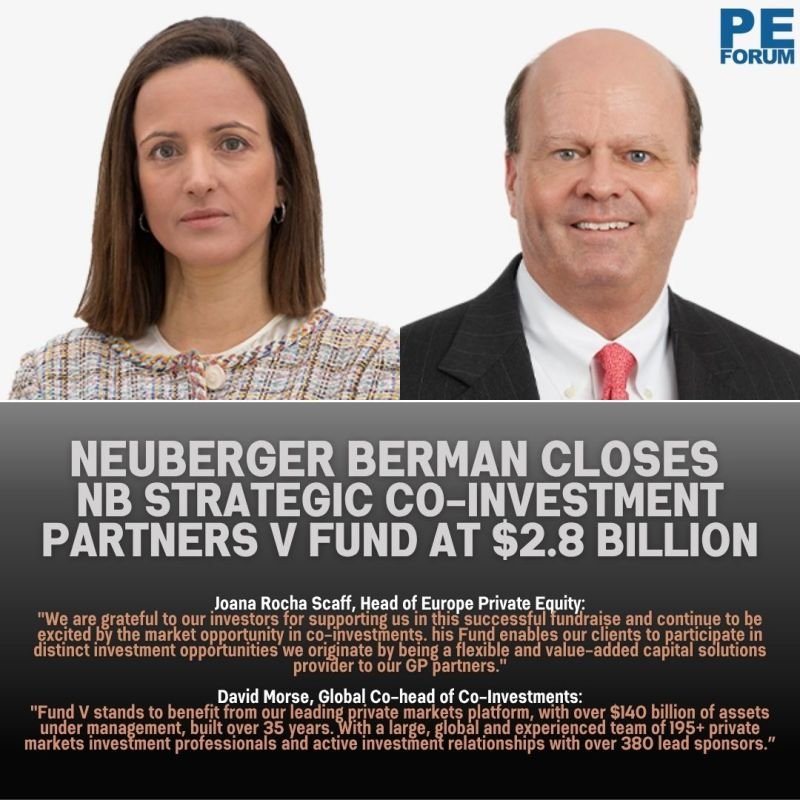

– Joana Scaff, Head of Europe Private Equity, highlighted the Fund’s role in providing flexible capital and participating as a co-underwriter in new deals or mid-life investments in sponsor-owned companies.

– Since January 2024, Neuberger has raised approximately $6 billion in client capital dedicated to co-investments.

– David Morse, Global Co-head of Co-Investments, emphasized the strength of Neuberger’s private markets platform with over $140 billion in AUM.

– The firm employs over 195 private markets professionals and maintains active investment relationships with more than 380 lead sponsors.

– Fund V is expected to benefit from this scale, expertise, and global reach to deliver compelling investment opportunities.