– January Capital announced the final close of its Growth Credit Fund. The fund was oversubscribed, securing more than US$130 million in total commitments

– January Capital is a Singapore-headquartered venture capital and multi-strategy investor focused on technology firms across Asia-Pacific

– The Growth Credit Fund provides less-dilutive financing through senior secured loans to growth-stage, sponsor-backed technology companies

– Typical financing size ranges from US$10 million to US$20 million

– The fund aims to fill a critical capital gap in Asia-Pacific, where growth credit is largely absent

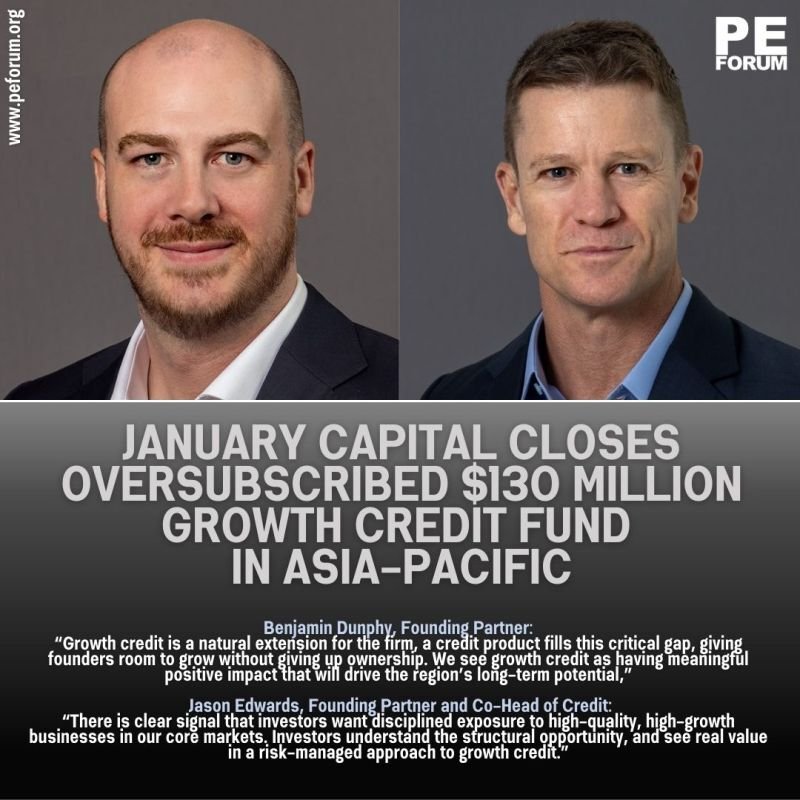

– Founding partner Benjamin Dunphy described growth credit as a natural extension of January Capital’s strategy. He highlighted the lack of non-dilutive financing options for tech founders in the region

– January Capital views growth credit as a way to support long-term regional growth without founders giving up ownership

– The fund attracted a strong and diverse group of institutional investors

– Investors include Australian Philanthropic Services Foundation, SBI Holdings USA, Inc., GMO Payment Gateway, Inc., and Orient Growth Ventures

– Founding partner and co-head of credit Jason Edwards said global investor interest reflects demand for disciplined exposure to high-growth companies

– The fund aims to offer loans of US$5 million to US$20 million to growth-stage technology companies in Asia-Pacific

– The fund has already deployed capital to five category-leading companies in the region

– Term sheets have been signed for five additional transactions expected to close in Q1 2026

– January Capital invests across Asia-Pacific through two core strategies: early-stage venture equity and growth-stage credit