– J.P. Morgan Asset Management Closes $1.5B Forest & Climate Solutions Fund II, Exceeds Target

– J.P. Morgan Asset Management has closed Campbell Global’s Forest & Climate Solutions Fund II at $1.5 billion, surpassing its $1 billion target.

Including separate account mandates, the total capital raised reaches $2.3 billion.

– Fund launched in 2022, marking the first since J.P. Morgan’s 2021 acquisition of Campbell Global.

– Strategy combines timber production with carbon sequestration, enhancing biodiversity and climate resilience.

– Investors include U.S. institutions, international banks, European pensions, insurers, and asset managers.

– Fund currently holds ~212,000 acres of sustainably managed timberland in the U.S. Pacific Northwest and South.

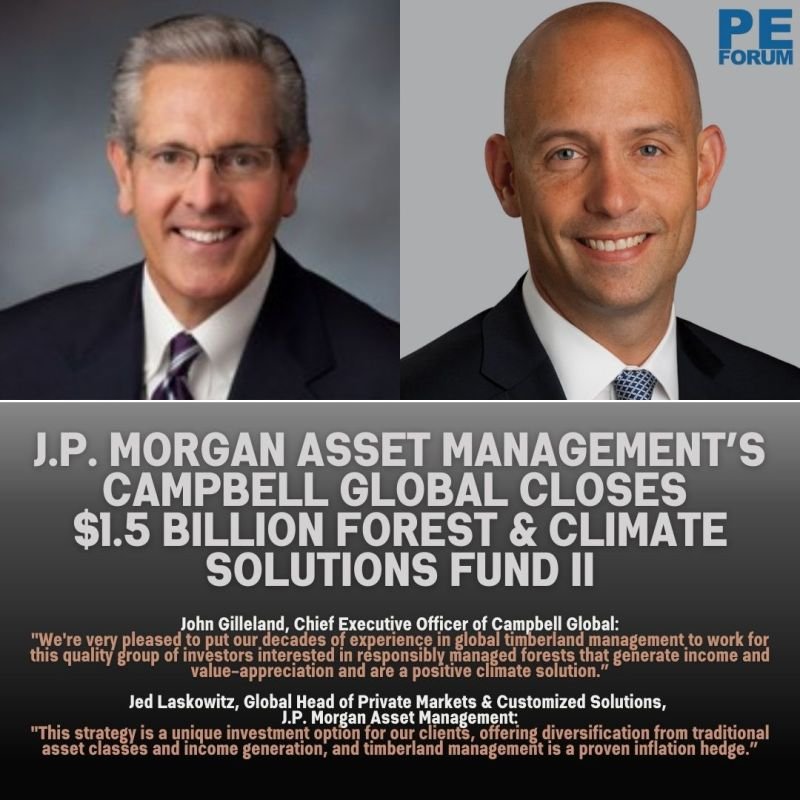

– John Gilleland, Chief Executive Officer of Campbell Global: “We’re very pleased to put our decades of experience in global timberland management to work for this quality group of investors interested in responsibly managed forests that generate income and value-appreciation and are a positive climate solution.”

– Jed Laskowitz, Global Head of Private Markets and Customized Solutions, J.P. Morgan Asset Management: “This strategy is a unique investment option for our clients, offering diversification from traditional asset classes and income generation, and timberland management is a proven inflation hedge.”

– Properties are managed under Sustainable Forestry Initiative standards, balancing economic return and environmental stewardship.

– Campbell Global leverages decades of timberland management experience across OECD regions.

– Timberland is highlighted as a diversification tool and inflation hedge in private markets.