– Five Arrows, the alternative assets arm of Rothschild & Co, has completed fundraising for its sixth GP-led secondaries fund, Five Arrows Secondary Opportunities VI (FASO VI), securing €2 billion in commitments

– The fund exceeded its €1.5 billion target and is double the size of FASO V, reflecting strong investor demand for GP-led secondaries

– The raise brings total assets under management across the Five Arrows Multi-Strategies platform (FAMS) to over €28 billion

– Backed by a globally diversified group of investors including pension funds, insurers, corporates, family offices, and entrepreneurs, alongside significant commitments from Rothschild & Co, staff, and FASO’s investment executives

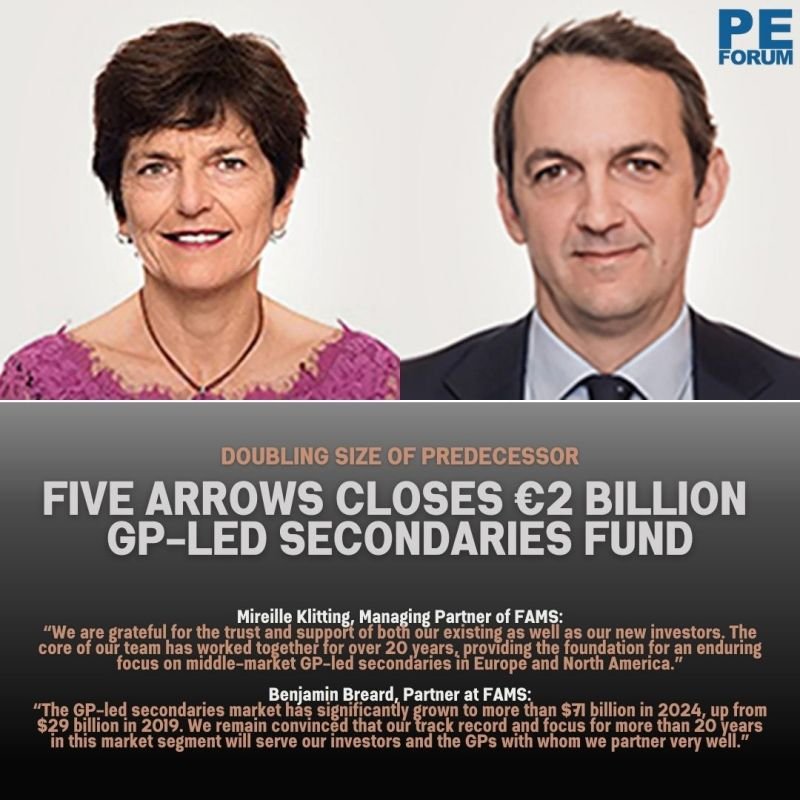

– Mireille Klitting, Managing Partner of FAMS, said: “We are grateful for the trust and support of both our existing as well as our new investors. The core of our team has worked together for over 20 years, providing the foundation for an enduring focus on middle-market GP-led secondaries in Europe and North America.”

– Benjamin Bréard, Partner at FAMS, commented: “The GP-led secondaries market has significantly grown to more than $71 billion in 2024, up from $29 billion in 2019. We remain convinced that our track record and focus for more than 20 years in this market segment will serve our investors and the GPs with whom we partner very well.”

– FASO VI is already over 50% committed, having signed 14 transactions at the time of final close

– The FASO team has grown to nearly 40 investment professionals based in Paris, New York, and Luxembourg