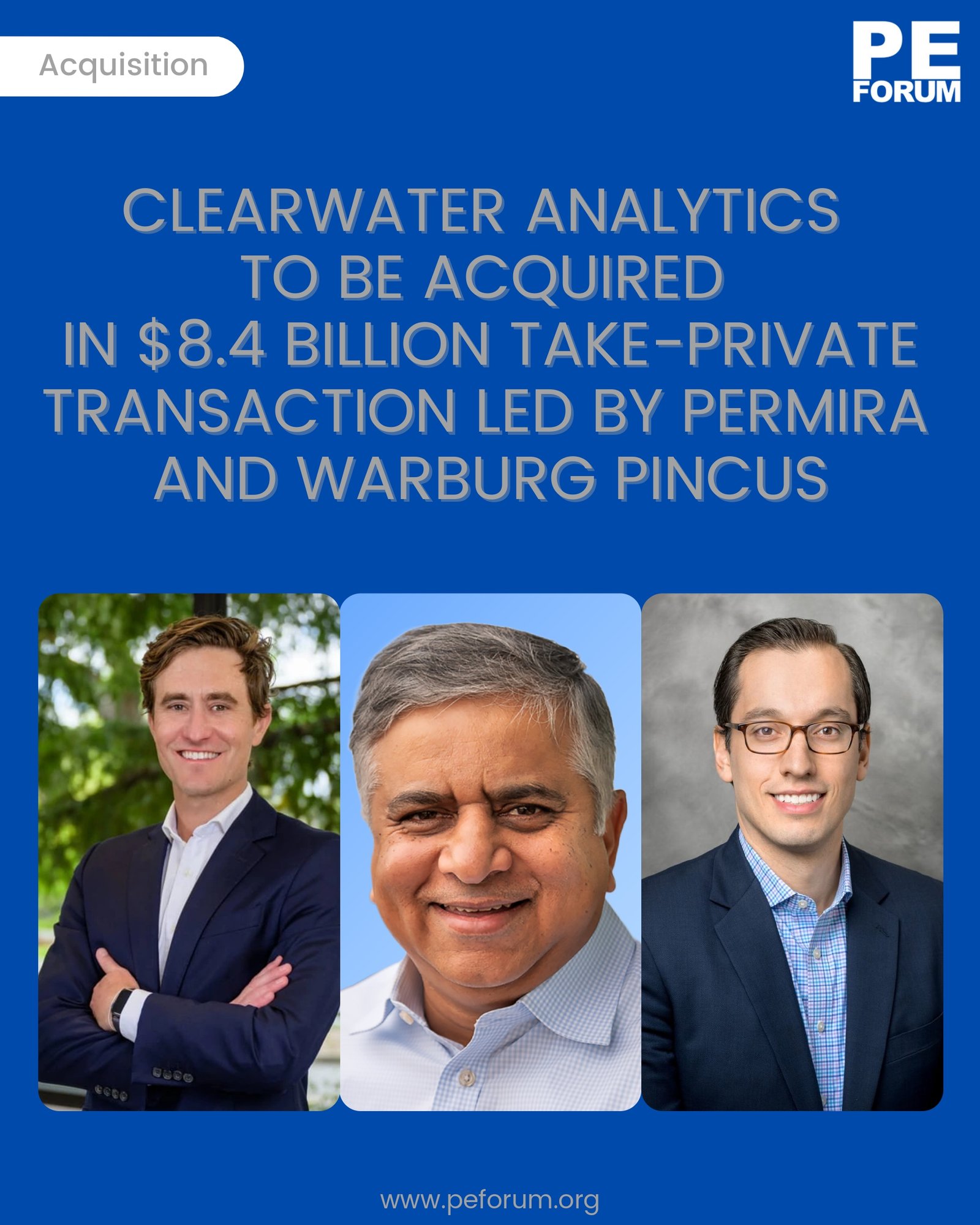

– Clearwater Analytics has entered into a definitive agreement to be acquired in a transaction valued at approximately $8.4 billion

– The acquisition will be led by Permira and Warburg Pincus, with participation from Temasek and key support from Francisco Partners

– A Special Committee of independent CWAN Board members reviewed the transaction and unanimously recommended it; the full Board approved it

– CWAN stockholders will receive $24.55 per share in cash, representing a 47% premium over the undisturbed share price as of November 10, 2025

– CEO Sandeep Sahai said the deal is a strong outcome for stockholders, positions CWAN for growth as a private company, and enables bold investment in platform integration, alternative assets, risk analytics, and AI-driven solutions

– Alex Stratoudakis, Managing Director at Warburg Pincus, said CWAN continues to set the standard for excellence in building an open, modular, front-to-back investment management platform

– Angel Pu Shum, Principal at Warburg Pincus, said they look forward to leveraging their fintech expertise and partnering with Permira and CWAN to drive innovation and growth

– Andrew Y., Partner at Permira, said CWAN’s multi-tenant investment accounting platform is differentiated and well positioned to lead the next cycle shaped by AI and data

– Alberto Riva, Managing Director at Permira, said they are excited to support Sahai and his team in delivering a seamlessly integrated front-to-back platform

– Ashley Evans, Partner at Francisco Partners, said the company’s growing leadership across US and European institutional investors is evident and expressed enthusiasm for supporting its next phase of growth

– CWAN will continue operations as usual during the transaction, maintaining its commitment to clients, employees, and partners