Eiffel Energy Transition III Raises €1.2 Billion, Exceeding Hard Cap and Accelerating Green Energy in Europe

– Eiffel Investment Group successfully raises the Eiffel Energy Transition III fund, reaching its hard

– Eiffel Investment Group successfully raises the Eiffel Energy Transition III fund, reaching its hard

– Integrity Growth Partners (IGP), a growth‑equity firm focused on founder‑owned, growth‑stage technology companies, closed

– Brookfield and Qai, a subsidiary of Qatar Investment Authority (QIA), announced a strategic partnership

– WTW , a global advisory and solutions company, announced the acquisition of FlowStone Partners,

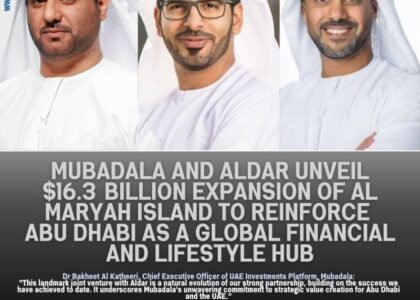

• Mubadala and Aldar launched a major joint venture to expand Al Maryah Island and

– RingAltitude II, Ring Capital’s Growth Buy-out fund, has closed at €217 million, marking a

• Edizione S.p.A. (Benetton family holding) has agreed to merge its private capital activities with

• MKB Equity Partners Inc. announced the final close of its third fund, MKB Partners

– Sculptor Capital Management announced the final close of Sculptor Real Estate Fund V with

• WindRose Health Investors closed its seventh fund, WindRose Health Investors VII, at $2.6 billion.