– Blueprint Equity announced the single closing of its $333 million third fund, Blueprint Equity III, LP

– Fund III was significantly oversubscribed and closed in just 12 days

– Blueprint Equity is a San Diego–based growth equity firm founded in 2018

– Both Fund I and Fund II are top-ventile performing private equity funds globally

– Fund III will make initial investments of $5–15 million

– Target companies are high-growth, capital-efficient enterprise software, B2B, and technology-enabled services businesses

– Target companies generate $1–7 million in revenue

– Fund III is backed by endowments, foundations, and hospital systems

– Existing investors include Accolade Partners, The David and Lucile Packard Foundation, and Makena Capital Management, LLC Management

– Blueprint focuses on founder-led businesses with strong early momentum and untapped sales and marketing potential

– The value creation team supports talent recruitment, sales and marketing execution, pricing optimization, and M&A sourcing

– Since inception, Blueprint has completed 24 platform investments

– The firm has executed seven partial recapitalizations

– Fund III reinforces Blueprint’s strategy of being the first institutional partner for disciplined, scalable growth

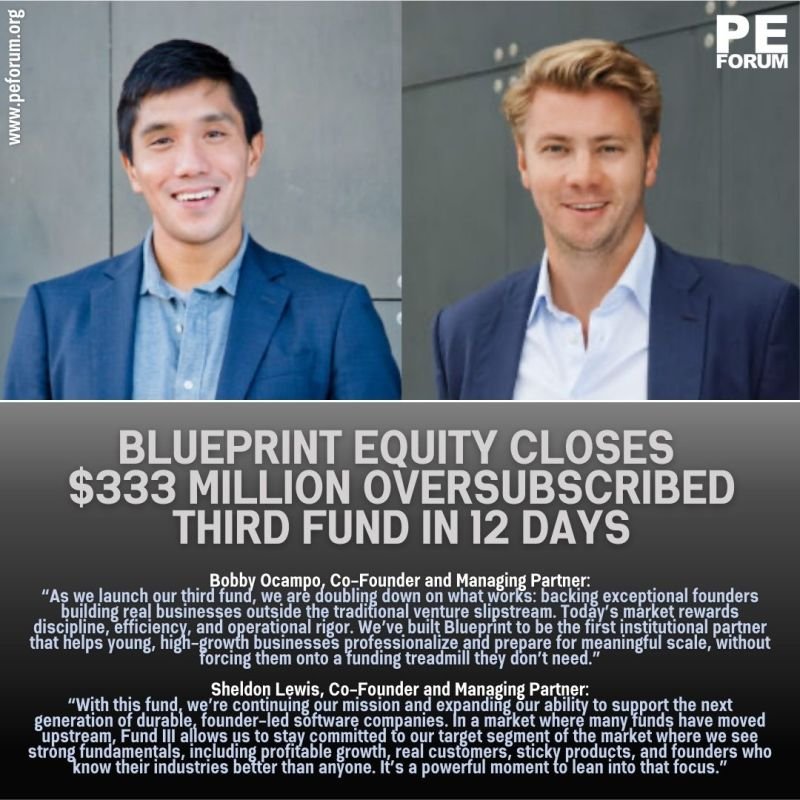

– Bobby Ocampo, Co-Founder and Managing Partner, Blueprint Equity: Emphasized doubling down on disciplined, capital-efficient growth by partnering early with exceptional founders and helping them scale without unnecessary funding pressure

– Sheldon Lewis, Co-Founder and Managing Partner, Blueprint Equity: Highlighted continued focus on founder-led software companies with strong fundamentals, profitable growth, and deep industry expertise, despite many funds moving upstream

– Aram Verdiyan, Partner, Accolade Partners: Praised Blueprint as an elite, disciplined growth equity manager with an exceptional team and results that made re-investing an obvious decision