– Ares Management Corporation, a leading global alternative investment manager, announced it has raised approximately $5.3 billion for its Infrastructure Secondaries strategy.

– The total includes the final closing of Ares Secondaries Infrastructure Solutions III (ASIS III), General Partner commitments, and affiliated vehicles.

ASIS III closed above its initial $2 billion target, reaching approximately $3.3 billion in equity commitments.

– The fund is more than three times larger than its 2021 predecessor.

The total capital raised ranks among the largest infrastructure secondaries campaigns to date.

– ASIS III will invest in a diversified portfolio of seasoned private infrastructure assets through flexible secondary solutions, including:

▪️Preferred structure transactions

▪️GP-led continuation vehicles

▪️Traditional LP interest acquisitions

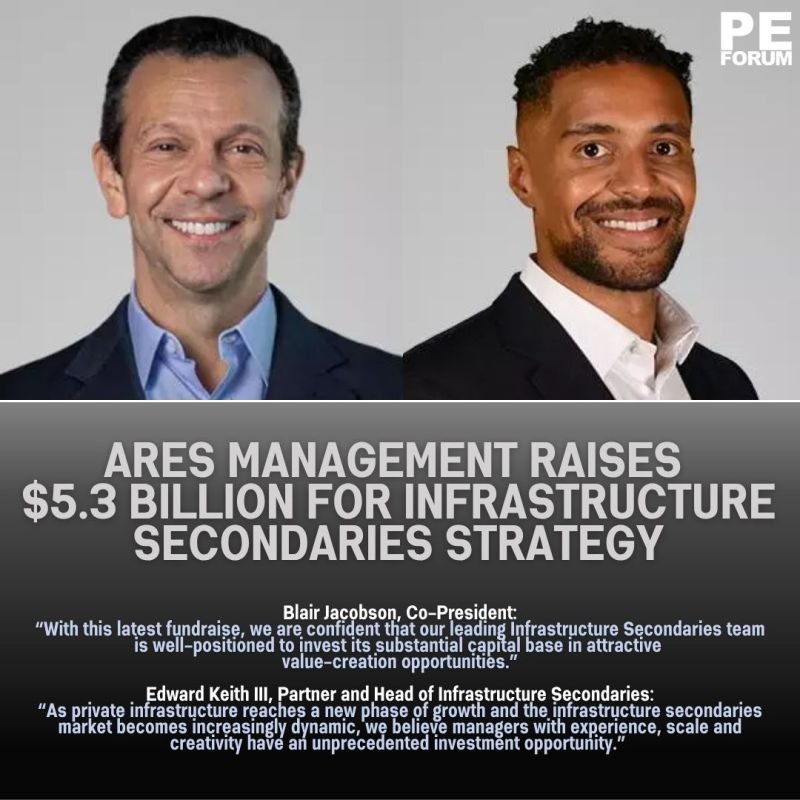

– Blair Jacobson, Co-President of Ares, emphasized the firm’s ability to deploy substantial capital into value-creation opportunities and its focus on specialized products across asset classes.

– Edward Keith III, Partner and Head of Infrastructure Secondaries, highlighted the growing opportunities in the evolving infrastructure secondaries market and the strength of Ares’ integrated platform.

– The Infrastructure Secondaries strategy is part of the Ares Secondaries Group, which has over a 30-year track record and manages nearly $34 billion in assets across infrastructure, real estate, private equity, and credit.

– The Ares Infrastructure platform includes over 130 investment professionals managing more than $21 billion in assets, supported by the firm’s Quantitative Research Group for private markets insights.