– Eldridge and Carlyle AlpInvest announced the successful closing of Eldridge Diversified Credit Fund I (EDCF I), the first fund in Eldridge’s diversified credit platform

– Carlyle AlpInvest, as a limited partner, and its co-investors made an equity commitment to Eldridge-managed vehicles

– Combined with debt financing from BNP Paribas, the structure is expected to provide up to approximately $1.5 billion in investable capital

– EDCF I was established through a credit secondary solution anchored by the purchase of a diversified portfolio of loans and leases from Eldridge and its affiliates

– The fund includes commitments from leading institutional investors globally

– The platform aims to meet evolving institutional borrower needs while generating attractive returns through a multi-strategy credit approach

– The fund is designed with flexible structuring to support borrowers across the capital structure

– Carlyle AlpInvest highlighted Eldridge’s combination of corporate credit capabilities and asset-based equipment origination as a key strength

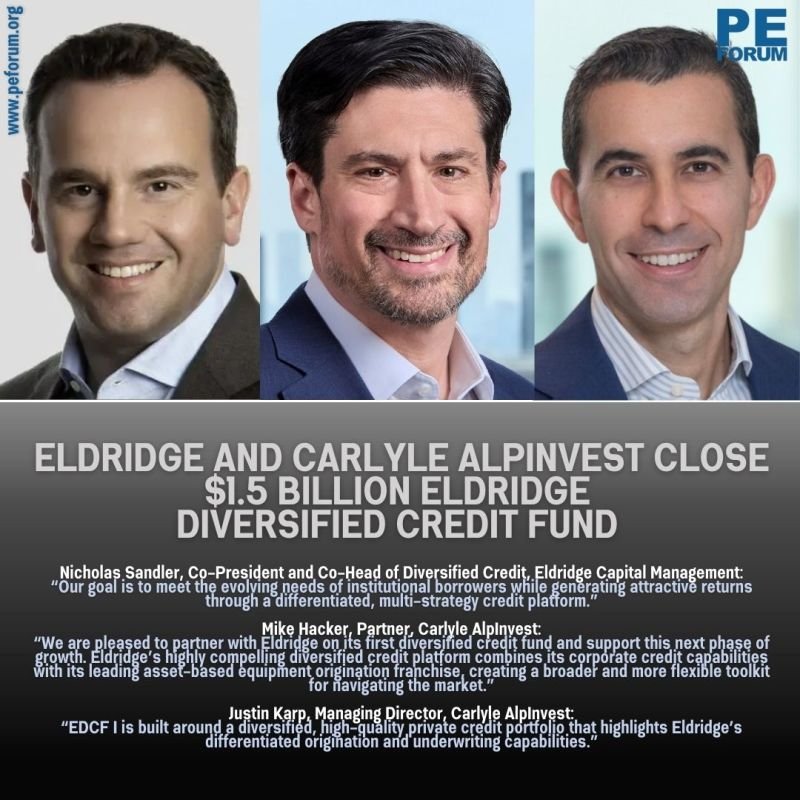

– Nicholas Sandler, Co-President and Co-Head of Diversified Credit, Eldridge Capital Management: “Our goal is to meet the evolving needs of institutional borrowers while generating attractive returns through a differentiated, multi-strategy credit platform.”

– Michael Hacker, Partner, Carlyle AlpInvest: “We are pleased to partner with Eldridge on its first diversified credit fund and support this next phase of growth. Eldridge’s highly compelling diversified credit platform combines its corporate credit capabilities with its leading asset-based equipment origination franchise, creating a broader and more flexible toolkit for navigating the market.”

– Justin Karp, Managing Director, Carlyle AlpInvest: “EDCF I is built around a diversified, high-quality private credit portfolio that highlights Eldridge’s differentiated origination and underwriting capabilities.”

– EDCF I focuses on a diversified, high-quality private credit portfolio supported by differentiated origination and underwriting

– BNP Paribas arranged and led a senior credit facility supporting the fund