– P10, Inc. and RCP Advisors announced the final close of RCP Secondary Opportunity Fund V, LP (“RCP SOF V”).

– The fund closed oversubscribed at $1.26 billion in capital commitments, surpassing its $1 billion target.

– Investors include high-net-worth individuals, pension funds, endowments, foundations, and insurance companies.

– RCP SOF V continues the investment style of RCP Advisors’ previous secondary funds.

– The fund targets secondary market purchases and transactions (both LP and GP-led) in private equity funds focused on leveraged buyout, growth, and restructuring deals.

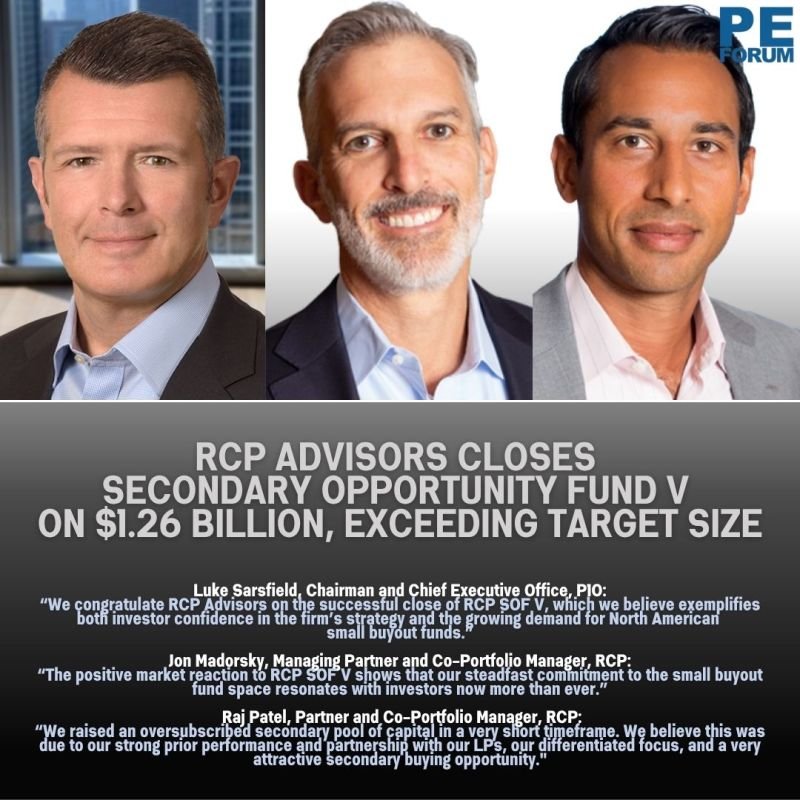

– Luke Sarsfield, P10 Chairman and CEO, highlighted the fund’s success as evidence of investor confidence in RCP’s strategy and the strong demand for North American small buyout funds. He emphasized P10’s goal of providing access to differentiated investments in the lower middle market.

– Jon Madorsky, RCP Managing Partner and Co-Portfolio Manager, noted strong investor resonance with RCP’s commitment to the small buyout space.

– Raj Patel, RCP Partner and Co-Portfolio Manager, credited the oversubscribed raise to strong performance, strong LP relationships, differentiated focus, and favorable secondary market conditions.

– RCP SOF V aims for a successful investment period following its accelerated fundraising timeline.