– Peak Rock Capital LLC announced the final closing of Peak Rock Capital Fund IV LP and parallel funds (“Fund IV”) and Peak Rock Capital Credit Fund III LP and parallel funds (“Credit Fund III”).

– Fund IV closed at its $2.5 billion hard cap, exceeding the $2.0 billion target.

Credit Fund III and hybrid credit/equity vehicles raised approximately $500 million.

– Predecessor Fund III closed at $2.0 billion in April 2021.

– Fund IV and Credit Fund III will focus on middle-market companies.

– The funds aim to support senior management with growth and profit improvement.

– Investment focus includes family- and founder-owned businesses and carve-outs.

– Target sectors are technology, industrial, consumer, and healthcare.

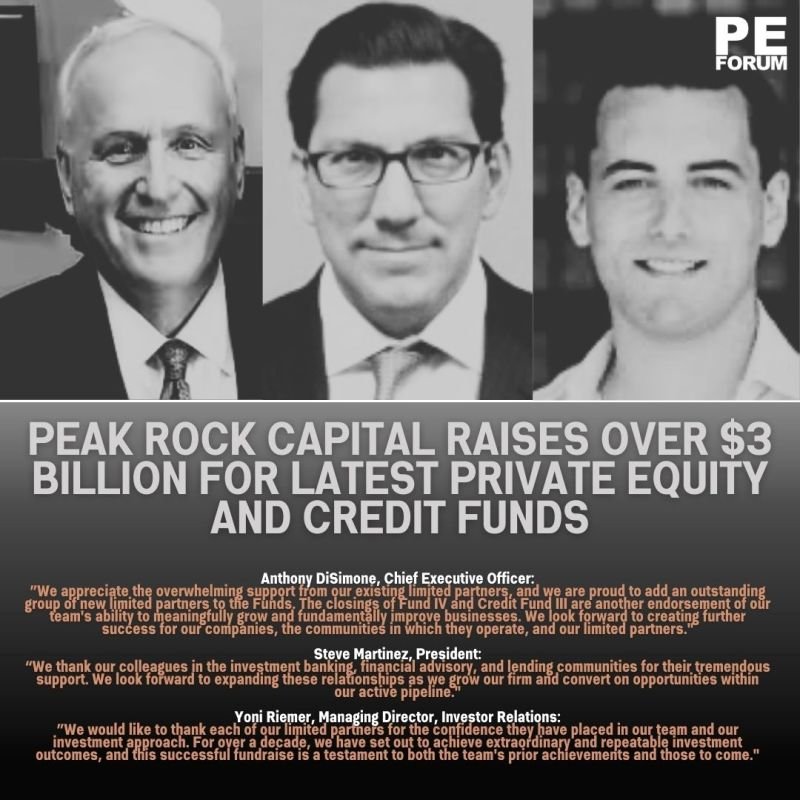

– CEO Anthony DiSimone highlighted support from LPs and the firm’s ability to grow businesses.

– Managing Director of Investor Relations Yoni Riemer emphasized investor confidence and repeatable outcomes.

– President Steve Martinez thanked investment banking, advisory, and lending partners and noted pipeline opportunities.

– Fund IV and Credit Fund III include investors such as pensions, sovereign wealth funds, health systems, endowments, foundations, insurance companies, family offices, and consultants.

– Kevin Wessel and Jeff Kaplan of Kirkland & Ellis LLP served as legal counsel.