– 17Capital announced the final closing of Strategic Lending Fund 6 with $5.5 billion in total commitments, including co-investments and affiliated vehicles.

– Fund 6 follows Fund 5, which closed at $2.9 billion in July 2021.

– It is one of the five largest private credit funds closed in 2025.

– Total capital raised by 17Capital since inception now stands at $19 billion.

– Investor base includes global pension funds, insurance firms, sovereign wealth funds, family offices, and endowments from North America, Europe, the Middle East, and Asia.

First fund raised since 17Capital’s strategic partnership with Oaktree Capital Management, L.P., a global credit specialist.

– Fund 6 has already deployed $2.5 billion across 10 investments, split evenly between the US and Europe.

– The Fund supports non-dilutive, flexible capital solutions for GPs to:

Fund larger GP commitments

– Support franchise growth and consolidation

– Facilitate succession plans

– In addition to Strategic Lending, 17Capital runs a Credit program offering NAV loans to private equity buyout funds.

– Since launching its inaugural Credit Fund in 2020 (closed at €2.6 billion), the firm has deployed $6.7 billion in NAV loans through the Credit program.

– NAV loans are seeing growing market adoption, reinforcing 17Capital’s leadership in fund-level financing.

– 17Capital pledged a portion of carried interest from Fund 6 to Epic, a global nonprofit helping disadvantaged youth.

– This continues a philanthropic initiative started with Fund 4 in 2017.

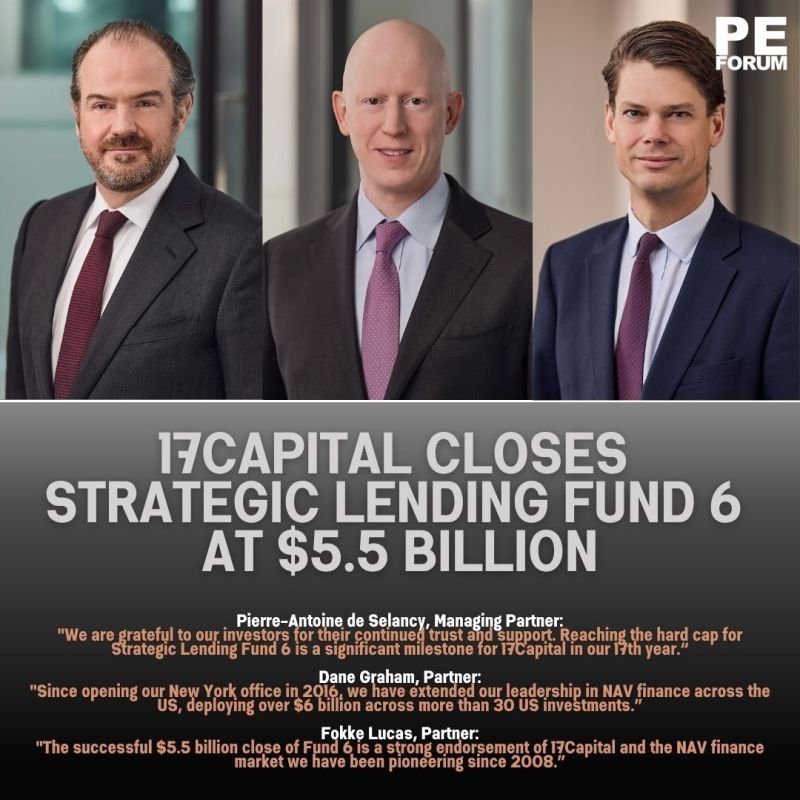

– Pierre-Antoine de Selancy, Managing Partner: Celebrated hitting the hard cap and reinforcing 17Capital’s leadership in NAV finance in its 17th year.

– Dane Graham, Partner: Highlighted over $6 billion deployed in the US and strong support from US-based investors.

– Fokke Lucas, Partner: Emphasized the $5.5 billion close as validation of NAV finance as a standalone private credit asset class.