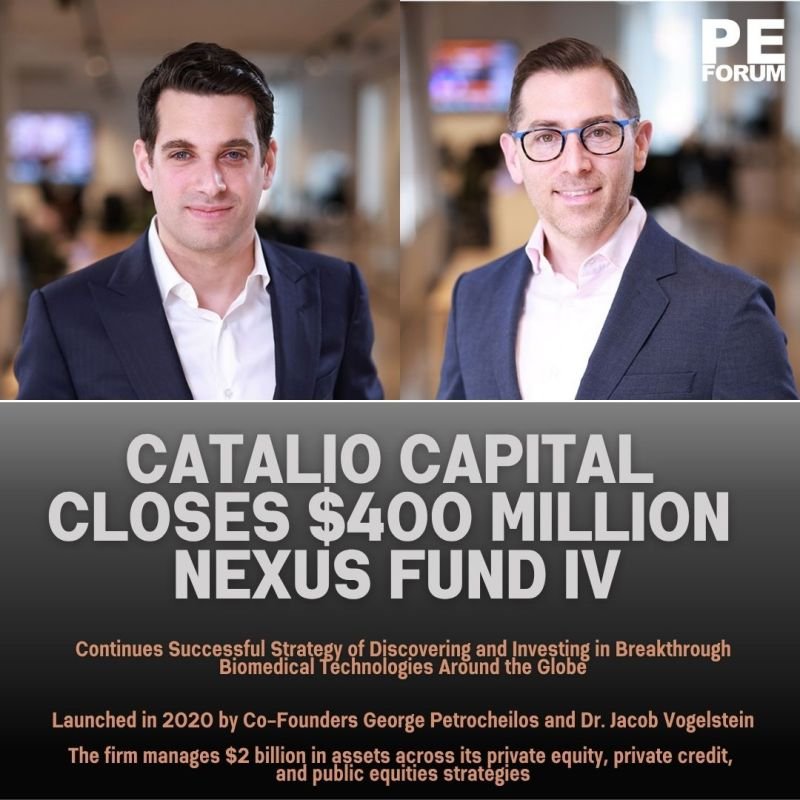

– Catalio Capital Management has closed its fourth venture fund, Catalio Nexus Fund IV, with over $400M in commitments across the Fund and its related co-investment vehicles.

– The Fund attracted backing from both existing investors and new global institutional investors, including RIAs, foundations, and endowments.

– This fundraise strengthens confidence in Catalio’s strategy of investing in biomedical technology companiesfounded by serial scientist-entrepreneurs.

– Founded in 2020 by George Petrocheilos and Dr. R. Jacob Vogelstein, Catalio manages $2 billion in assets across private equity, private credit, and public equities.

– Olga Maltseva, Partner & Head of Operations, emphasized the importance of the Fund’s timing amid a historic buyer’s market in biotech.

– Catalio’s investment focus is on transformative healthcare companies emerging from leading academic institutions.

– Dr. Diamantis Xylas emphasized Fund IV’s focus on near-term liquidity and long-term growth through investments in breakthrough biomedical technologies.

– Since inception, Catalio’s Nexus funds have backed 80+ private companies, with multiple exits via M&A or IPO, and annual distributions to LPs.

– Fund IV has already made 16 investments, continuing Catalio’s strategy of supporting life sciences businesses from early stages through IPO.

Fund IV highlights include:

▪️ Co-led PinkDx, Inc.’s $40M Series A to develop diagnostics for gynecological cancers.

▪️ Invested in Superluminal Medicines Inc.’ Series A, expanding Catalio’s AI-enabled drug discovery portfolio.

▪️ Launched two new companies:

🔺 Rhapsogen, co-founded by Dr. Jeffrey Ravetch (Rockefeller University)

🔺 TBD Pharma, co-founded by Dr. Bert Vogelstein (Johns Hopkins University)

▪️ Participated in late-stage investments:

🔺 $150M Series E for Imperative Care (medical devices)

🔺 PIPE for Protara Therapeutics

🔺 $180M Series D for Alentis Therapeutics (antibody drug conjugates for oncology)