– Sanari Capital, a Women-led and majority Black-owned private equity firm based in South Africa raised approximately R1.5 billion ($80 million) for the Sanari 3S Growth Fund. Focused on transformative potential across Africa.

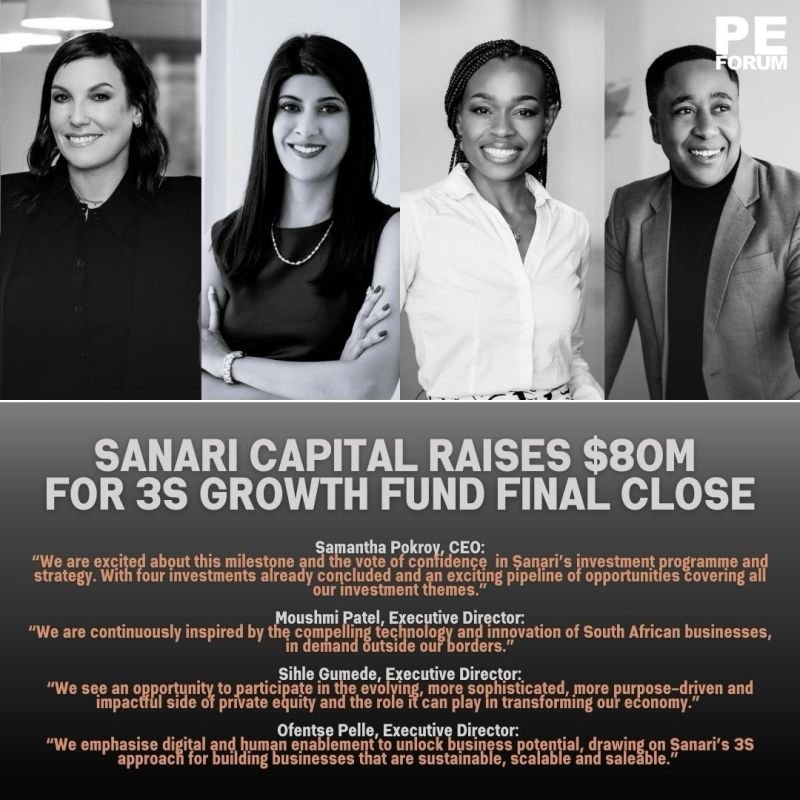

– Samantha Pokroy, CEO:

“We are excited about this milestone and the vote of confidence in Sanari’s investment programme and strategy. With four investments already concluded and an exciting pipeline of opportunities covering all our investment themes.”

– Moushmi Patel, Executive Director:

“We are continuously inspired by the compelling technology and innovation of South African businesses, in demand outside our borders.”

– Sihle P Gumede, Executive Director:

“We see an opportunity to participate in the evolving, more sophisticated, more purpose-driven and impactful side of private equity and the role it can play in transforming our economy.”

– Ofentse Pelle, CFA MBA, Executive Director:

“We emphasise digital and human enablement to unlock business potential, drawing on Sanari’s 3S approach for building businesses that are sustainable, scalable and sale-able.”

– Four investments concluded with a robust pipeline aligned with key investment themes.

– Targets well-established businesses at an inflection point driven by technology, innovation, and growth drivers. Invests up to R250 million per business. Portfolio includes companies with ~60% hard-currency revenues due to export orientation and geographic expansion.

– Promotes diversity and transformation. Fosters economic growth, job creation, and social, environmental, and financial returns. Emphasizes sustainability, scalability, and saleability (3S approach).

– Investor Base includes major institutions such as the Public Investment Corporation, Alexforbes Investments, 27four Investment Managers Black Business Growth Fund, TELKOM RETIREMENT MANAGEMENT COMPANY Fund, MOTOR INDUSTRY RETIREMENT FUNDS (via RisCura) and the National Fund for Municipal Workers (NFMW).