– Monroe Capital LLC announces the closing of its inaugural collateralized fund obligation (CFO), Monroe Capital CFO I, Ltd., totaling $315 million.

– The CFO offers investors exposure to a diversified portfolio of Monroe’s strategies, including:

– Senior secured direct lending

– Alternative credit solutions platforms

– Rated and non-rated securities

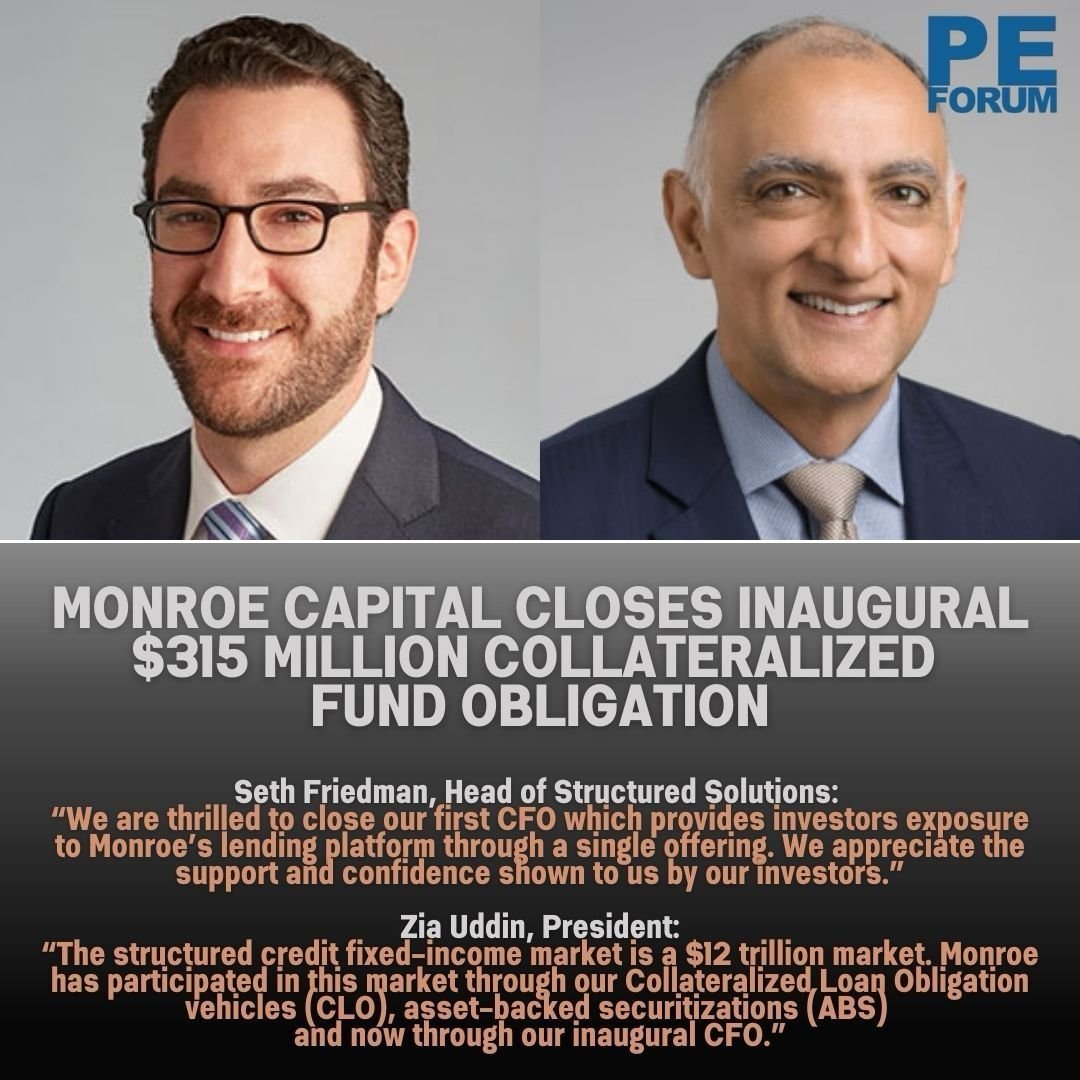

– Seth Friedman, Head of Structured Solutions, expressed excitement about the CFO’s closure, highlighting its ability to offer exposure to Monroe’s lending platform through a single offering and appreciation for investor support.

– Zia Uddin, President of Monroe, discussed the $12 trillion structured credit fixed-income market, noting Monroe’s history of participation through CLOs, asset-backed securitizations (ABS), and the new CFO.

– The CFO’s capital-efficient structure is tailored to meet the needs of insurance companies and other rating-focused investors.

– Jefferies acted as Lead Structuring Agent and Sole Placement Agent.

– The Carlyle Group served as Structuring Advisor, and Dechert LLP provided legal advice to Monroe.

– As of October 1, 2024, Monroe Capital manages $19.4 billion in assets under management (AUM) and a diverse private credit platform of 45+ vehicles, including direct lending, alternative credit solutions, venture debt, BDCs, separately managed accounts, and CLOs.