– 50 South Capital Advisors, LLC, Northern Trust Asset Management’s global alternatives arm, announced final closings of two flagship private equity funds

– Private Equity Strategic Opportunities Fund V (PESOF V) closed with $1.2 billion in commitments

– Private Equity Core Fund XI (PECF XI) closed with $893 million in commitments

– Investors include wealth managers, family offices, intermediaries, consultants, and institutions

– PESOF V is the fifth dedicated secondaries fund by 50 South Capital

– PESOF V follows a multi-strategy approach to secondaries, including LP-led transactions, GP-led continuation vehicles, and structured/preferred equity solutions

– PESOF V builds on over 15 years of experience in the secondaries market

– PESOF V focuses on less competitive and more complex segments of the market

– PESOF V leverages a proprietary sourcing ecosystem developed over nearly 25 years

– PECF XI is the eleventh core flagship private equity fund from 50 South Capital

– PECF XI invests globally across primary, secondary, and co-investment opportunities

– PECF XI emphasizes U.S. and European small and middle market buyouts

– PECF XI also targets seed and early-stage venture capital investments

– PECF XI strategy is built on diversification across geography, vintage, sector, and strategy

– PECF XI benefits from Northern Trust’s global reach and selective, conviction-driven investment approach

– Adam Freda, Managing Director and Head of Secondaries, emphasized the value of complex deals and proprietary sourcing

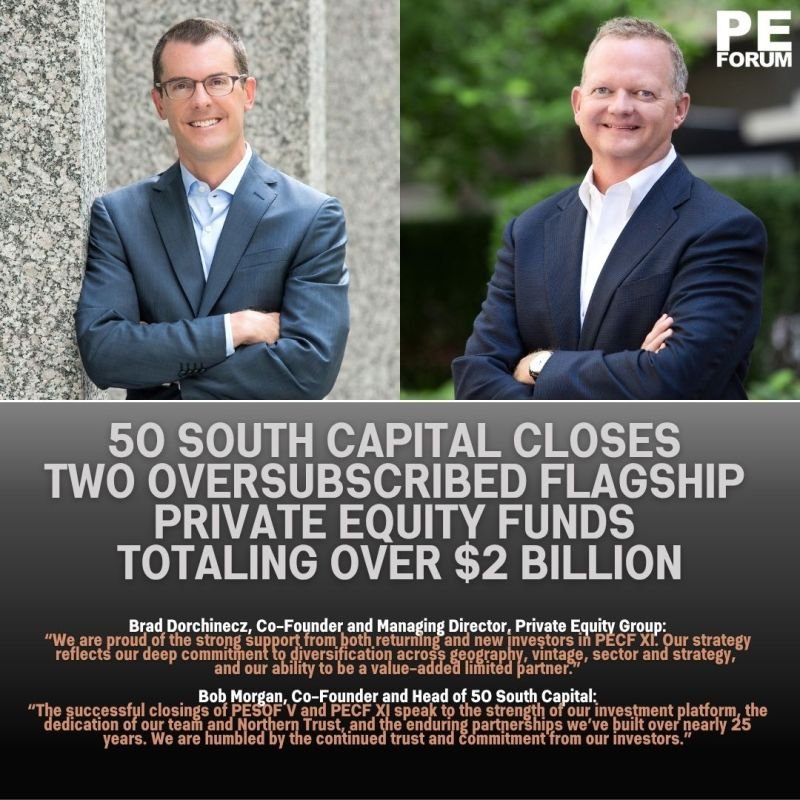

– Bradley Dorchinecz, Co-founder and Managing Director of Private Equity, highlighted diversification and 50 South Capital’s role as a value-added limited partner

– Bob Morgan, Co-founder and Head of 50 South Capital, credited fundraising success to the strength of the investment platform, team, and long-standing investor partnerships